Angry French Pensioners Offer the World a Warning, US Pensions are not much betterAndreas Kluth,

1 / 2

Angry French Pensioners Offer the World a Warning

(Bloomberg Opinion) -- When it comes to retirement, France is like other countries, only more so: Everything about its system is untenable. It’s untenable that it has 42 separate public pension schemes — one for train drivers, another for opera singers, and so on. It’s untenable that the French think they have a God-given right to retire at 62 or even earlier. And it's untenable that they tend to riot in the streets every time the government tries to confront these realities.

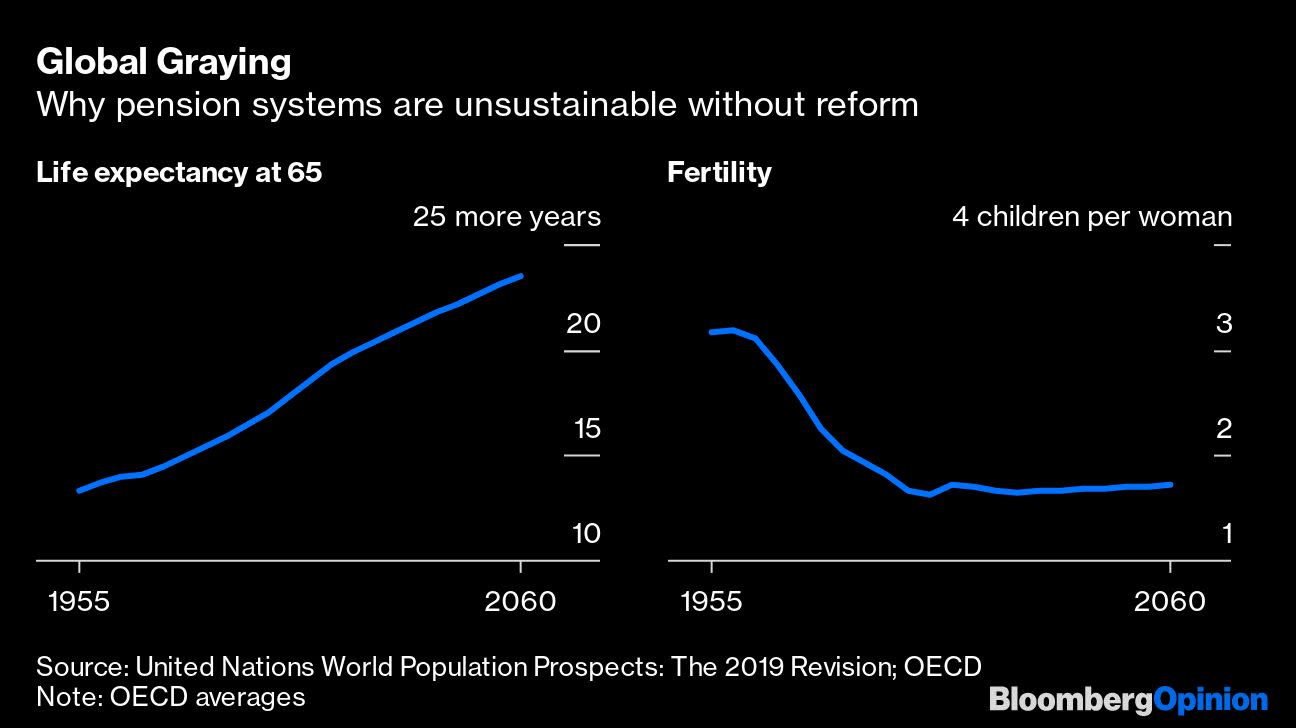

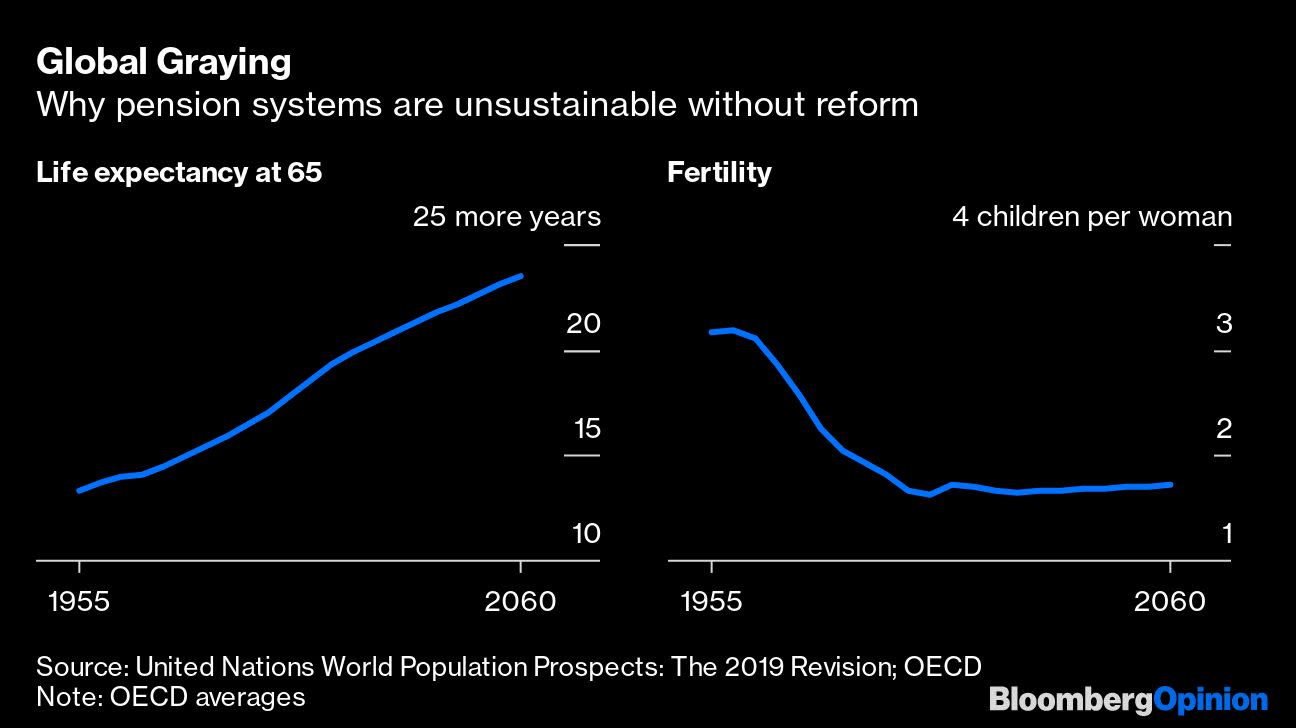

If they chose a slightly different perspective, the French might actually have reason to celebrate. After all, like people across almost the whole world, they can expect to live longer. The only problem is that unless they also work longer, this means they’ll need to draw their pensions for more years. Moreover, because of lower fertility in recent generations, fewer young people will be financing these pensions.

This global retirement crisis is a slow-ticking time bomb, not as dangerous as climate change but almost as consequential for financial markets, living standards and much else. This year, almost one in 10 people in the world will retire, according to the United Nations; by 2070, it’ll be about one in five.

The crisis isn’t evenly distributed. Africa, for once, has less of a problem, because of its relative youth. In North America, the problem is big. In Asia and Europe, it’s huge. The world’s “oldest” country (demographically) is Japan, and one of the fastest-aging is South Korea. The oldest continent is Europe, and countries such as Greece, Poland, Portugal, Slovakia, Slovenia and Spain are among those aging fastest.

Policymakers really only have three big dials to address this dilemma.

One is the contribution rate: how much people of working age are required to pay into the system. That rate is trending upward in rich countries. This represents an increasing burden on young people trying to get started in their careers (and questioning whether the system will even be around when they themselves retire). The alternative to making workers pay more is to fund shortfalls out of government coffers, which is a great plan to create the next sovereign-debt crisis.

The second policy dial is the replacement rate: the income level of retired people relative to what they made when they were still working. These rates range from as low as about 30% in Lithuania, Mexico or the U.K. to as high as 90% in Austria, Italy, Portugal or Turkey. Because most pension systems are unsustainable, these levels will go down almost everywhere. That means many old people will end up poor.

Story continues

Votes: 4.88 Stars!This post was viewed 478 times.

Votes: 4.88 Stars!This post was viewed 478 times.

Votes: 4.88 Stars!This post was viewed 478 times.

Votes: 4.88 Stars!This post was viewed 478 times. /cdn.vox-cdn.com/uploads/chorus_image/image/65992818/x085_3f73_9.0.jpg) Carlos Boozer, Derrick Rose, Joakim Noah, Luol Deng and Kyle Korver huddle up during a 2011 playoff game. Nam Y. Huh/AP Photo

Carlos Boozer, Derrick Rose, Joakim Noah, Luol Deng and Kyle Korver huddle up during a 2011 playoff game. Nam Y. Huh/AP Photo

/cdn.vox-cdn.com/uploads/chorus_image/image/65992857/burke_010419_02_80901718_e1548473497653.0.jpg) Ald. Ed Burke (14th) walks into the Dirksen Federal Courthouse in January 2019. Ashlee Rezin Garcia/Sun-Times

Ald. Ed Burke (14th) walks into the Dirksen Federal Courthouse in January 2019. Ashlee Rezin Garcia/Sun-Times

a

a

/cdn.vox-cdn.com/uploads/chorus_image/image/65962875/pace__5_.0.jpg) The Bears have been the ninth-worst team in the NFL during Pace’s years in charge. AP Photos

The Bears have been the ninth-worst team in the NFL during Pace’s years in charge. AP Photos/cdn.vox-cdn.com/uploads/chorus_image/image/65963341/merlin_88663263.0.jpg) Pushed by his sister, Beth Carter, former CPD officer Jim Crowley is welcomed home for Christmas in Chicago, Monday, December 23, 2019. Kevin Tanaka/For the Sun Times

Pushed by his sister, Beth Carter, former CPD officer Jim Crowley is welcomed home for Christmas in Chicago, Monday, December 23, 2019. Kevin Tanaka/For the Sun Times/cdn.vox-cdn.com/uploads/chorus_image/image/65948710/DEMCHAIR_041918_04.0.jpg) Joseph Berrios. Max Herman / Sun-Times

Joseph Berrios. Max Herman / Sun-Times

/cdn.vox-cdn.com/uploads/chorus_image/image/65948262/COUNCIL_121919_35.0.jpg) Ald. Matt O’Shea (19th) is concerned allowing women to bare their breasts at bars and restaurants licensed to sell liquor, could lead to the exploitation of women and possibly human trafficking. Ashlee Rezin Garcia/Sun-Times

Ald. Matt O’Shea (19th) is concerned allowing women to bare their breasts at bars and restaurants licensed to sell liquor, could lead to the exploitation of women and possibly human trafficking. Ashlee Rezin Garcia/Sun-Times

/cdn.vox-cdn.com/uploads/chorus_image/image/65942610/FRANSHOW_030219_08.0.jpg) Cook County Board President Toni Preckwinkle. Ashlee Rezin Garcia / Sun-Times

Cook County Board President Toni Preckwinkle. Ashlee Rezin Garcia / Sun-Times