Angry French Pensioners Offer the World a Warning, US Pensions are not much better

Andreas Kluth,

1 / 2

Angry French Pensioners Offer the World a Warning

(Bloomberg Opinion) -- When it comes to retirement, France is like other countries, only more so: Everything about its system is untenable. It’s untenable that it has 42 separate public pension schemes — one for train drivers, another for opera singers, and so on. It’s untenable that the French think they have a God-given right to retire at 62 or even earlier. And it's untenable that they tend to riot in the streets every time the government tries to confront these realities.

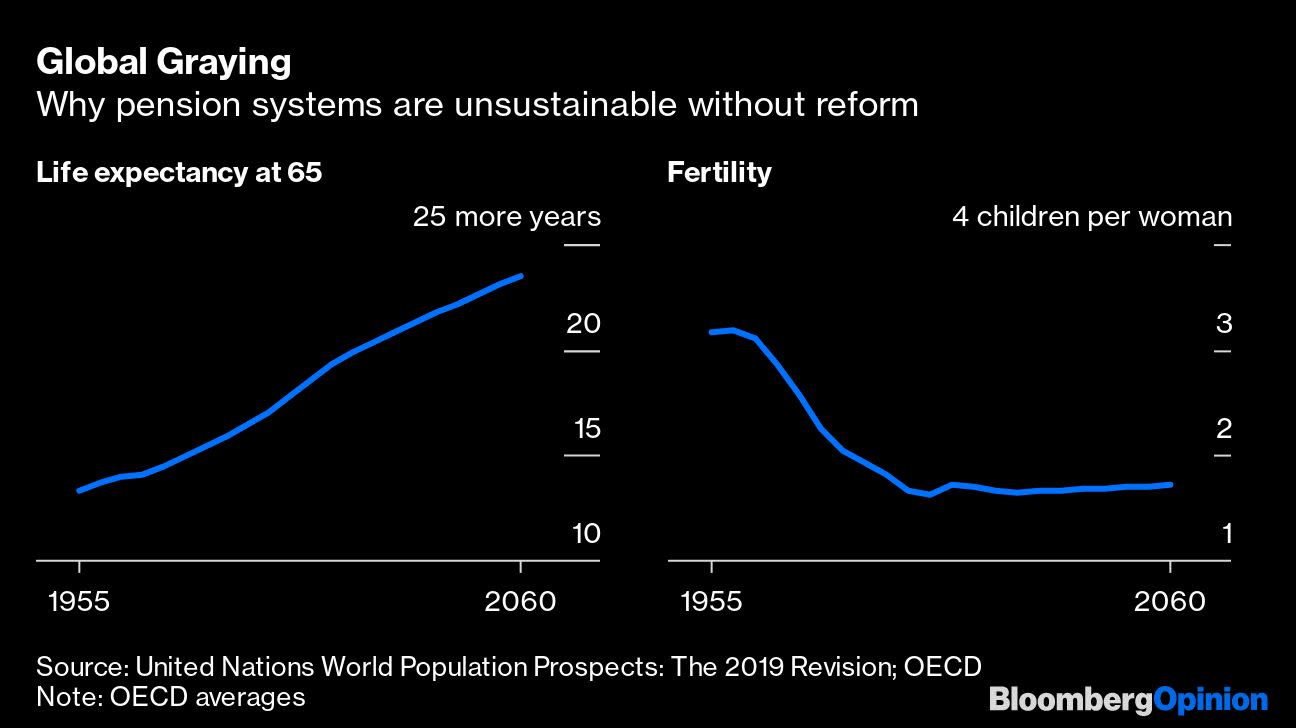

If they chose a slightly different perspective, the French might actually have reason to celebrate. After all, like people across almost the whole world, they can expect to live longer. The only problem is that unless they also work longer, this means they’ll need to draw their pensions for more years. Moreover, because of lower fertility in recent generations, fewer young people will be financing these pensions.

This global retirement crisis is a slow-ticking time bomb, not as dangerous as climate change but almost as consequential for financial markets, living standards and much else. This year, almost one in 10 people in the world will retire, according to the United Nations; by 2070, it’ll be about one in five.

The crisis isn’t evenly distributed. Africa, for once, has less of a problem, because of its relative youth. In North America, the problem is big. In Asia and Europe, it’s huge. The world’s “oldest” country (demographically) is Japan, and one of the fastest-aging is South Korea. The oldest continent is Europe, and countries such as Greece, Poland, Portugal, Slovakia, Slovenia and Spain are among those aging fastest.

Policymakers really only have three big dials to address this dilemma.

One is the contribution rate: how much people of working age are required to pay into the system. That rate is trending upward in rich countries. This represents an increasing burden on young people trying to get started in their careers (and questioning whether the system will even be around when they themselves retire). The alternative to making workers pay more is to fund shortfalls out of government coffers, which is a great plan to create the next sovereign-debt crisis.

The second policy dial is the replacement rate: the income level of retired people relative to what they made when they were still working. These rates range from as low as about 30% in Lithuania, Mexico or the U.K. to as high as 90% in Austria, Italy, Portugal or Turkey. Because most pension systems are unsustainable, these levels will go down almost everywhere. That means many old people will end up poor.

Story continues

Margaret Thatcher once said that "The trouble with Socialism is that eventually you run out of other people's money."

ReplyDeleteI worked 40yrs to earn a pension I paid my share why didn't the government pay their share? Earned pensions is not socialism!

DeleteRule number one, ACT ALONE tell NOBODY, EVER. Don't say cutesie innuendos at the bar.Plan. Make it quick and decisive. Know the risks. Do it. Shut your mouth. Repeat keep your mouth SHUT. Conscience may bother you on occasion and give you doubt about your actions. Ignore it it'll pass. Remember you did civilization a solid.

ReplyDeletehttps://www.libertarianism.org/podcasts/building-tomorrow/who-wants-retire-millionaire?

ReplyDeleteTime to copy Australia's retirement system!