Treasury Sees 2018 Borrowing Needs Surging to $1.34 Trillion

Specifically, the department expects to issue $425 billion in net marketable debt from October through December, lower than the $440 billion estimated in July, according to a statement released Monday in Washington. The Treasury sees an end-of-December cash balance of

$410 billion, compared with its previous forecast of $390 billion.

From July through September, the Treasury said it issued $353 billion in net marketable debt, compared with its earlier prediction of $329 billion in borrowing. The cash balance was $385 billion at the end of September.

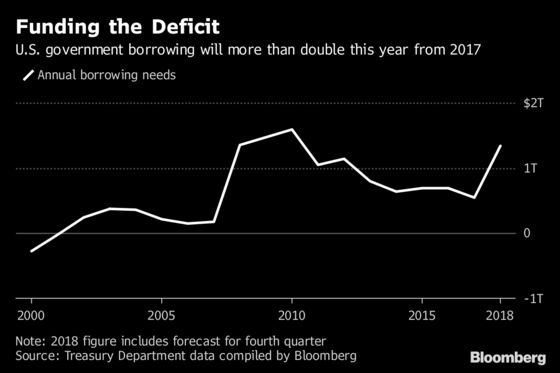

Treasury borrowed $72 billion in the second quarter and $488 billion in the first three months of the year. According to Bloomberg calculations based on the Treasury data, borrowing this year will be the highest since 2010, when America was emerging from recession.

The Treasury is boosting sales of bills, notes and bonds in part to help finance a budget gap that’s widening after President Donald Trump signed $1.5 trillion in tax cuts late last year and the Republican-controlled Congress approved a roughly $300 billion spending increase. Meanwhile, the Federal Reserve is shrinking its balance sheet and choosing not to replace its holdings of some Treasuries as they mature, and an aging population is boosting costs of federal programs such as Medicare.

The federal budget deficit grew to a six-year high of $779 billion in the 12 months through Sept. 30, which was Trump’s first full fiscal year in office. The Congressional Budget Office, a nonpartisan arm of Congress, forecasts government spending will outweigh revenue by $973 billion in fiscal 2019 and more than $1 trillion the next year.

From January through March next year, the Treasury predicted issuance of $356 billion in net marketable debt, with a $320 billion cash balance at the end of the period.

The quarterly borrowing estimates released Monday precede the department’s quarterly refunding announcement on Oct. 31, when the sizes of longer-term debt auctions are announced.

©2018 Bloomberg L.P.

No comments:

Post a Comment