Mark Hulbert

Total margin debt has nearly doubled since March 2000

GETTY IMAGES

GETTY IMAGESMargin debt’s new all-time high is neither bullish nor bearish. I’m referring to the total amount that investors have borrowed to purchase stocks. Because the effect of margin is to leverage stocks’ gains, its marketwide level is a measure of investor confidence.

To the bulls, rising margin debt means investor sentiment should be strong enough to propel the market higher. To the bears, in contrast, it is a contrarian indicator, with high levels indicating dangerous levels of speculative excess.

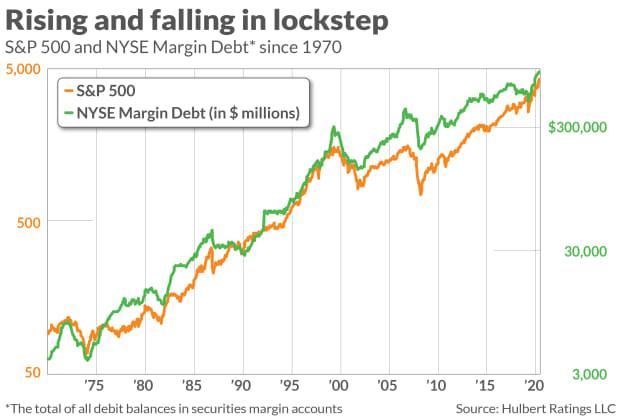

My review of the historical data suggests that margin debt has no bullish or bearish significance. Consider the chart below, which plots margin debt over the past 50 years alongside the S&P 500 SPX, -0.08%. Notice that the two series rise and fall in close lockstep with each other. When the S&P 500 hits a new high, for example, almost always margin debt will hit a new high as well. That means we learn nothing about the future by focusing on margin debt that we wouldn’t learn by focusing on the S&P 500 itself.

I confirmed this upon subjecting the five decades’ worth of margin data to a number of econometric tests. I found no statistically significant correlation between margin debt hitting a new all-time high and the stock market’s subsequent performance.

Hindsight bias

Analysts often are guilty of so-called “hindsight bias” when they reach different conclusions. To illustrate, consider that the top of the internet bubble occurred in March 2000. It certainly seems significant, in retrospect, that margin debt also hit a new all-time high that same month.

But this conclusion involves a sleight of hand. There were 43 months over the decade prior to March 2000 in which margin debt hit a new all-time high. Only in retrospect can we know that the 43rd of those new all-time highs coincided with the top of the market. There would have been no way of knowing, in real time, that those other 42 cases were not signaling a market top.

The bottom line? Margin debt’s new-all-time high in the latest reporting month might coincide with the final top of this incredible bull market. Or it might not. Analysts need to look to other indicators beside margin debt for help in determining which it might be.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Sounds like making of another pre 1992 bubble in the Japan economy?

ReplyDeleteIs it time to pull the 401k and take the penalty???

ReplyDeleteJust transfer the 401k holding into money market funds or bonds in your 401k. No Penalty. When its over put your preserved nest egg back into equities based mutual funds in you 401k.

DeleteDepression is coming!!

ReplyDeleteStockpile lots of canned and dry goods

ReplyDelete